1. Cash App Introduces Comparable High-Yield Savings Features as the Apple Card

1. Cash App Introduces Comparable High-Yield Savings Features as the Apple Card

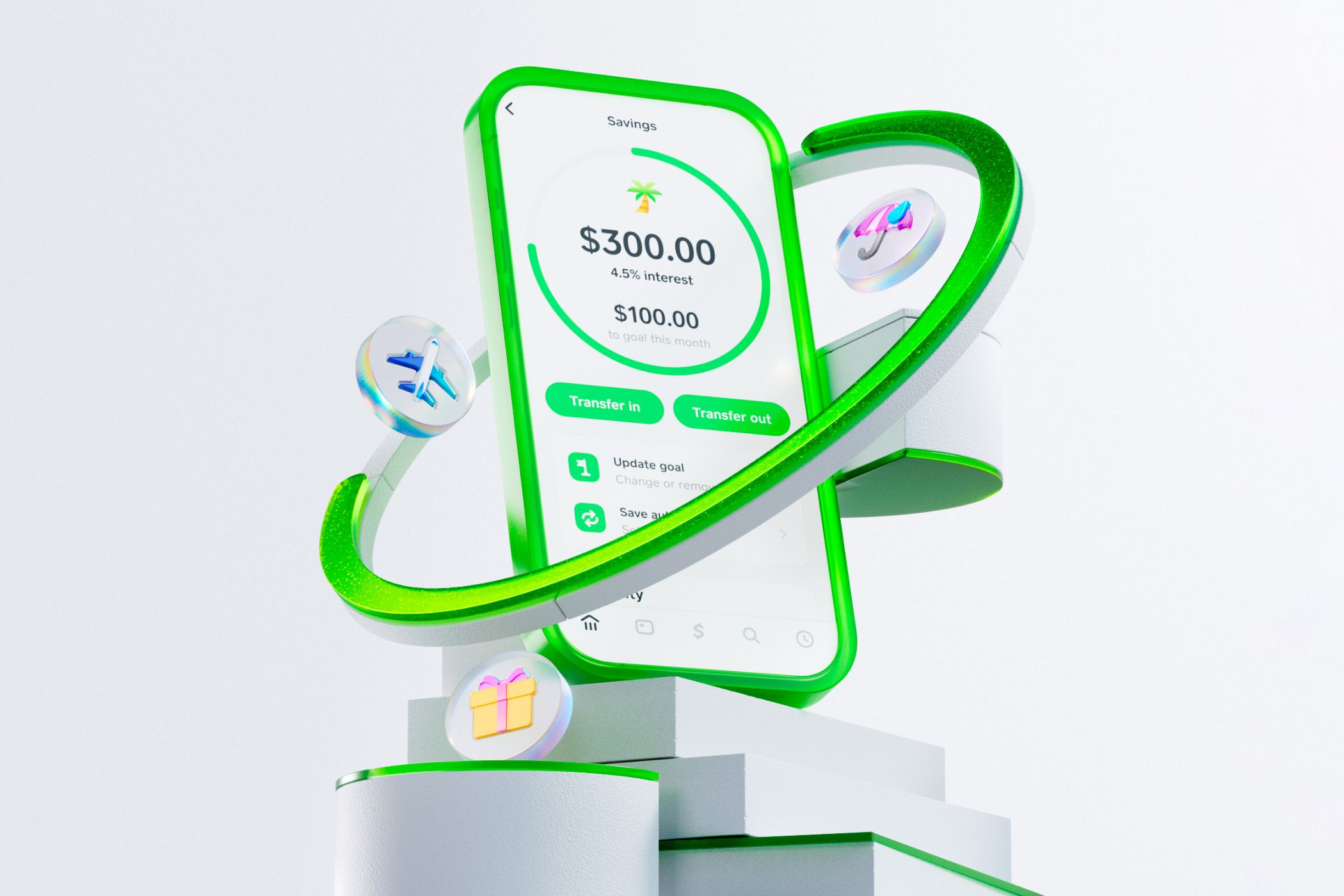

Cash App is best known as a simple way to send and recieve money on phones, but it also has some attached banking services, like a debit card. Cash App just updated its connected savings account with a 4.5% interest rate—the same as Apple Card’s savings account.

Cash App Savings is an FDIC-insured savings account, with no hidden fees or minimum account requirements. The annual percentage yield, or APY, has now been updated to 4.5%. That means money in the savings account will earn interest at the same rate as the Apple Card savings account (which started at 4.15% but is currently 4.5% ). It’s also close to some other competing savings accounts, such as SoFi with its 4.6% APY , and much higher than the interest rates at most big banks. Notably, the savings account is accessible through the regular Cash App on both iPhone and Android, and isn’t limited to iPhones like the Apple Card savings account.

There are a few requirements before you can start accumulating money, though. You need to order a Cash App Card , then set up direct deposit to put at least $300 in paychecks each month to unlock the 4.5% APY. That higher interest rate will remain as long as the direct deposits continue each month, otherwise it will drop to the standard 1.5% APY. That’s similar to how the savings accounts at SoFi and other fintech banks work—it’s easier to sell you on other financial products (Cash App has stock trading, for example) when you use it as your primary bank with direct deposit for paychecks.

Apple’s high interest rate savings account has helped spur competition, though we still don’t know what the future holds for the Apple Card ecosystem. Apple’s primary banking partner, Goldman Sachs, has reportedly been trying to break away because the Apple Card isn’t profitable enough. The money in those accounts are insured by the FDIC, so that’s not as risk of vanishing suddenly, but customers could eventually be migrated to other banks or updated with a lower APY.

The interest rate for all savings accounts is also patially based on the Federal Reserve’s funds rate , which is expected to start dropping in 2024, so all these accounts might have lower interest rates in a year from now. For the moment, though, it’s great to see another option for savings account with a high interest rate.

Source: Cash App via TechCrunch

Also read:

- 2024 Approved From First Steps to Expertise Lenovo’s Guide to Recording Success

- Dial Down ASUS Laptop Display Flash Quickly

- Essential Considerations Before Buying the Perfect Smartwatch - Top 5 Insights

- Fitbit Versa 3: Harnessing Inbuilt GPS + Health Apps to Supercharge Your Workout Motivation Level!

- How To Unlock iPhone SE (2020) 3 Ways To Unlock

- IMessage Image Vanishing Issue? Here's the Ultimate Guide to Resolving It !

- In 2024, Clear Path for Your Instagram Videos Now

- In 2024, How to Change Location on TikTok to See More Content On your Itel A70 | Dr.fone

- List of Pokémon Go Joysticks On Honor X9a | Dr.fone

- New 2024 Approved Text To Speech | Wondershare Virbo Online

- Reviving iPad Connectivity: Essential Steps for Reactivating the USB Driver

- Step-by-Step Guide: Fixing a Mac Frozen on the Startup with an Apple Icon Displayed

- The Encyclopedia Britannica – Anubis [Online] Available At:

- Trouble with iPhone Personal Hotspot? Here Are Proven Solutions to Restore Connectivity

- Title: 1. Cash App Introduces Comparable High-Yield Savings Features as the Apple Card

- Author: Daniel

- Created at : 2024-10-12 00:36:47

- Updated at : 2024-10-18 00:12:12

- Link: https://os-tips.techidaily.com/1-cash-app-introduces-comparable-high-yield-savings-features-as-the-apple-card/

- License: This work is licensed under CC BY-NC-SA 4.0.